Dollar hegemony as the World's Reserve Currency is being challenged by many nations that no longer trust the faith and credit of the United States Treasury…

Connecting the Dots Audio

Connecting the Dots Video

…Most pundits regardless of political affiliation see Donald Trump as a successful and shrewd businessman, very unlike most former presidents that were groomed from youth to be professional politicians; most being shepherded through Ivy League institutions with law and/or political science degrees and little actual working knowledge of free market capitalism. In the past, that disconnect worked because the U.S. had built a huge economic advantage based on: free markets, rule of law, property rights and an entrepreneurial spirit that permeated our powerful middle class. At the core of our free market system was a Constitution and Bill of Rights that gave Americans fundamental rights to own and freely utilize private property of wide description, and a stable monetary regime backed by gold and silver. Surreptitious passage of the Federal Reserve Act in 1913 and a gradual transformation over time by bankers and feckless politicians, turned America from the world's greatest creditor to greatest debtor nation in less than 50 years. President Nixon's “temporary” closure of the gold window in 1971 cancelled any perceived connection between the Dollar and gold backing, and sent us on a reckless spending spree that has hollowed out our national economy and threatens to end forever America's role as the world's reserve currency.

The question becomes………not will it happen, but when, and under what circumstances? Economics was referred to by John Maynard Keynes as “the dismal science”. That dismal science has become less and less understood by a greater and greater number of Americans who are much more concerned about the schedule of the NFL than the strength of U.S. GDP. Americans are now among the least economically literate people on the face of the planet; not because they can't learn……it's because they refuse to learn. As long as the political class will promise them something for nothing, they will follow blindly right into the fiscal abyss.

A number of options have been proposed to keep the fiscal wheels on the American and world economy, but most are solutions that do little more than kick the can down the road one more time while exponentially increasing the power of Big Brother. Things like social credit systems, CBDCs and digital money in a cashless society give governments and international banksters unlimited control, and the ability to expand indebtedness from merely problematic to abject slavery. A return to a truly free market economy backed by actual assets rather than debt is the obvious solution, but the likelihood of the bankster class or politicians willingly giving up their enormous wealth and political advantage is not likely.

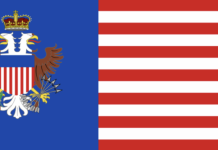

Donald Trump has always projected himself as a sound money guy with a complete understanding of risk/reward, debt, and the wise use of credit to ensure future economic growth. Investment can only happen when an economy has excess capital because our debt to GDP ratio is less than one to one. Simply stated; “with our short term debt at 37 trillion dollars and growing, nearly 200 trillion in unfunded future liabilities, and a GDP of just under 30 trillion dollars…………..the formula that provides adequate investment for long term growth no longer exists”. Quite frankly; the only reason that we've gotten away with this as long as we have is because interest payments for U.S. Treasury bonds have been held at artificially low rates for the past 15 years and the dollar's hegemony as the world's reserve currency. That gift was a carry over from the 1944 Bretton Woods treaty that made the gold backed U.S. Dollar the World's Reserve Currency.

Recently, the weaponization of the dollar for strictly political reasons has alarmed many, friend and foe alike. Many countries are selling their U.S. Treasury Bonds, choosing to purchase gold instead as a safer long term investment. A group of gold producing nations called BRICS (Brazil, Russia, India, China and South Africa are in discussions with nearly 50 other nations to create a new international basket of currencies 20-40% backed by gold that allows them to decouple from the dollar and engage in international commerce and finance using their own currencies. Although 60% of all international financial transactions are currently conducted in dollars, there is strong evidence that Dollar dominance is coming to an end.

Will President Trump be able to maintain dollar hegemony and restore our badly hollowed out industrial sector? Can he really make America great again? The failed fiat money experiment is without doubt coming to an end. The question is…..what will replace it, and will we be able to restore legitimacy to our financial order?